Value, inflation, Warren Buffett and speculation - the best investing blogs and podcasts from the past week

High inflation, rising rates, supply chain issues, looming recession, war… the troublingly long list of concerns facing investors this year has led to a predictable surge in stock market punditry. With so many unpredictable variables in play, the financial media is awash with articles endeavouring to make sense of issues that in many cases are impossible to make sense of.

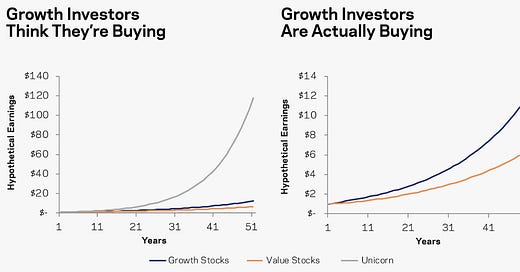

One axiom that’s been knocking about all over the place since last year is the idea that rising inflation is good for value stocks. And by virtue of that, bad for growth stocks. The idea - and it kind of makes sense intuitively - is that the future cash flows baked into the valuations of growth stocks get weaker when you’ve got high and rising inflation. The yang to that yin is that value stocks, whose cash flows are known right now, become more attractive in an inflationary environment.

I’ve seen this argument so often that it feels like an investment truism. Heck, I’ve even pedalled it in some of my own work. After all, it ties in nicely with the re-emergence of value as a profit driver in the stock market over the past year (after so long in the wilderness).

Except it seems like this actually isn’t the case at all. In an article earlier this month, Cliff Asness, the value-focused boss of AQR Capital, took a look himself at whether there was a meaningful correlation between high inflation and value outperformance, and guess what… there isn’t.

In Is Value Just an Interest Rate Bet Asness compares the rolling five-year monthly correlation between the Fama-French value factor returns in the US against the change in the US 10-year treasury yield over the same period. It turns out that long-term, there’s no clear connection between high inflation and value outperformance. But short term - over the past five years - there has been.

So what’s going on? Well, for Asness the answer is that bubbly valuations and irrationally exuberant assumptions of growth investors may have created the conditions for value to trade more correlated to interest rates than usual - and it might last a while yet. But generally, value and rising inflation and not best buddies after all.

Source: AQR

If you want to hear more discussion about these findings, a good podcast to catch up with is this week’s episode of Value After Hours with Toby Carlisle, Bill Brewster, and Jake Taylor - We’re In ‘The Boring 20s’ Market. That chat takes in subjects ranging from Adam Neumann, Michael Burry, the yield curve, market direction, meme stocks and short squeezes. Discussion of Cliff Asness’s study starts at 32 minutes in.

Top posts from the past week

Excess Returns - Talking All Things Value Investing with Tobias Carlisle

Apart from co-hosting Value After Hours, Toby Carlisle (mentioned above) was also on the Excess Returns podcast this week. The value factor has had a rough ride in the years since the financial crisis, which has been hard on value managers like Carlisle. He’s the author of The Acquirer’s Multiple and manages ETFs based on the value principles in the book. In this podcast he talks about the performance of value in recent years, his preferred approach to valuation (enterprise value to EBIT), and adding extra factors like ‘quality’. He also talks about sector concentration, evolving his process, how value could be changing and the importance of patience.

Neckar's Minds of the Market - Picking Stocks Like Warren Buffett

Ordinarily, a title like this would certainly be clickbait, but that’s not the style of Frederik Gieschen, who writes the excellent (and usually paywalled) Neckar's Minds of the Market blog. For many, Warren Buffet is an idol, but much of what’s written and understood about the man breezes over a huge amount of depth and complexity. This article is all about the pros and cons of stock picking and in particular the often overlooked aspects of community, camaraderie and the importance of life-long learning. There are millions of articles that unpick the reasons why Buffett has been so successful. But most miss the point that he simply found a way to take an almost “human alien” interest in business and channel it into a source of constant self-education, community and happiness.

Meb Faber Research - Episode #438: Rob Arnott & Campbell Harvey on Why They Believe Inflation Hasn’t Peaked

Rob Arnott and Cam Harvey are both giants in the field of quantitative investing. Arnott founded investment management firm Research Affiliates, and Harvey is head of research there. Apart from contributing some influential academic investigations into the use of factors in investing, Harvey also pioneered the use of the yield curve (the relationship between the yields of short and long dated treasuries) as a predictor of recessions. This conversation starts on that subject and picks apart the drivers of inflation and what central banks could, and perhaps should, do about it. From about 35 minutes, they discuss how inflation influences businesses and stock market prices. That includes strategies to mitigate inflation: with ideas covering international diversification and the fact that ‘value’ is cheap against historical norms pretty much everywhere. Towards the end (47 minutes) Meb gets Cam and Rob asking each other questions, which is worth the wait - with topics covering downside risk and avoiding the risks of data mining.

Investor Amnesia - How The Drivers Of Market Returns Evolved

There’s a great line in Jamie Catherwood’s latest article, which goes: “A company’s earnings don’t change on a whim, but investors’ willingness to pay higher multiples for the same stock do.” Here the focus is on the cycle of investor sentiment that periodically leads many to cast aside fundamentals and dive headlong into the market, happy to snap up the most speculative of stocks at sky-high valuations. When human nature becomes a key driver of multiple expansion in stocks, valuations become reliant on enthusiasm rather than anything else. But when the outlook changes, those valuations can quickly collapse. This is a must-read on the risks of ignoring what really matters in stocks. The post also appeared on the O’Shaughnessy Asset Management website under the title: Why Fundamentals Matter.

Novel Investor - Skill vs. Luck: Failing to Lose

The Novel Investor blog has been around for quite some time and it’s all about summarising investing ideas simply, with the help of insights from legends. This post on the role of skill and luck in the stock market is a reminder of the importance of having a solid process that you’re prepared to rely on, even if the outcome is sometimes not what you want. The post mentions the analyst Michael Mauboussin who is probably one of the most influential figures in this field. Mauboussin’s personal website was recently overhauled and now contains pretty much everything the guy has ever written, plus interviews. So if you want to explore more about this skill versus luck idea, a good place to start is at https://www.michaelmauboussin.com/ and this PDF file of his work from 2012-2013.

Have a great weekend - and don’t forget to check out the best of the rest investment blogs and podcasts below…

Ben

Thinking & Strategy (Blogs)

The active manager who stopped believing

The Evidence-Based Investor

9 Best Investing Twitter Accounts: Think Like an Investor

MyWallSt Blog

The building blocks of society that can act as an inflation hedge

Fund research from Trustnet

In Memoriam: Steve Holdsworth

ShareSoc

101 Financial Ratios & Metrics To Improve Your Investing Skills

Sure Dividend

Three Things I Think I Think – Bad Ideas

Pragmatic Capitalism

Navigating Inflation in Equity Portfolios

MSCI

Big Beliefs

Morgan Housel

10-Chart Tuesday (8/23/22)

Compound Advisors

Exceptions to the Rule

A Wealth of Common Sense

A Look at the Lightning Network

Lyn Alden

Thinking & Strategy (Podcasts)

The Value Perspective Podcast – with Az Phillips

The Value Perspective

Dennis McKenna—Rebooting Yourself with Psychedelics (EP.120)

Infinite Loops

Guy Hands, CEO of Terra Firma, on PE and Leveraged Buyouts [REPLAY]

The Money Maze Podcast

Joachim Klement – Stocks in the long run… are still risky (The Best Investment Writing Volume 6)

Meb Faber Show Podcast

Robert Smith - Investing in Enterprise Software - [Invest Like the Best, EP.291]

Invest Like the Best with Patrick O'Shaughnessy

#145 Les Snead: Building a Super Bowl Champion

The Knowledge Project with Shane Parrish

Pearls of Career Wisdom

Capital Allocators with Ted Seides

Bill Browder on High Finance, Murder and Justice (Podcast)

Masters in Business

Securities & Markets (Blogs)

Inflation proofed returns from AIM

Fundamental Asset Management

Jupiter's Bezalel and Richards: Don't be fooled by US relief rally

Fund research from Trustnet

Screening For My Next Long-Term Winner: CERILLION

Maynard Paton

10 Micro-Cap Companies That Have Seriously Outperformed Last 12 Months @Ycharts

The Acquirer's Multiple

All Danish Shares part 10 – Nr. 91-100

value and opportunity

Is Passive Ownership Bigger than Estimated?

Alpha Architect

Securities & Markets (Podcasts)

Animal Spirits: Price Drives Narrative

A Wealth of Common Sense

Siegel on Inflation, the Fed and Meme Stocks

What Goes Up

Eric Balchunas on the Vanguard Effect

Masters in Business

The Richard Hunter Interview: balancing risk and return in an exciting growth space

interactive investor

Atlas Copco: Sweden’s Best Kept Secret - [Business Breakdowns, EP. 71]

Business Breakdowns

E98 - NatWest, Coca-Cola HBC, BAE Systems, InterContinental Hotels Group, Entain & Disney

The Investor Way

Small Caps Podcast with Paul Scott – Episode 8

Quality Small Caps