Why Terry Smith was right (and wrong) about dividends

...and why share buybacks could be the next fight

Hello! I’m experimenting with an additional weekly article in the Fully Invested line-up. This is the first. If you receive an article this time next week, you’ll know I’m running with it!

As always feel free to message me with feedback or just to say hi.

Thanks for your support,

Ben

Back in April 2020 when we were all grappling with a world of Covid restrictions, Terry Smith, the fund manager, wrote an article for the FT about dividends.

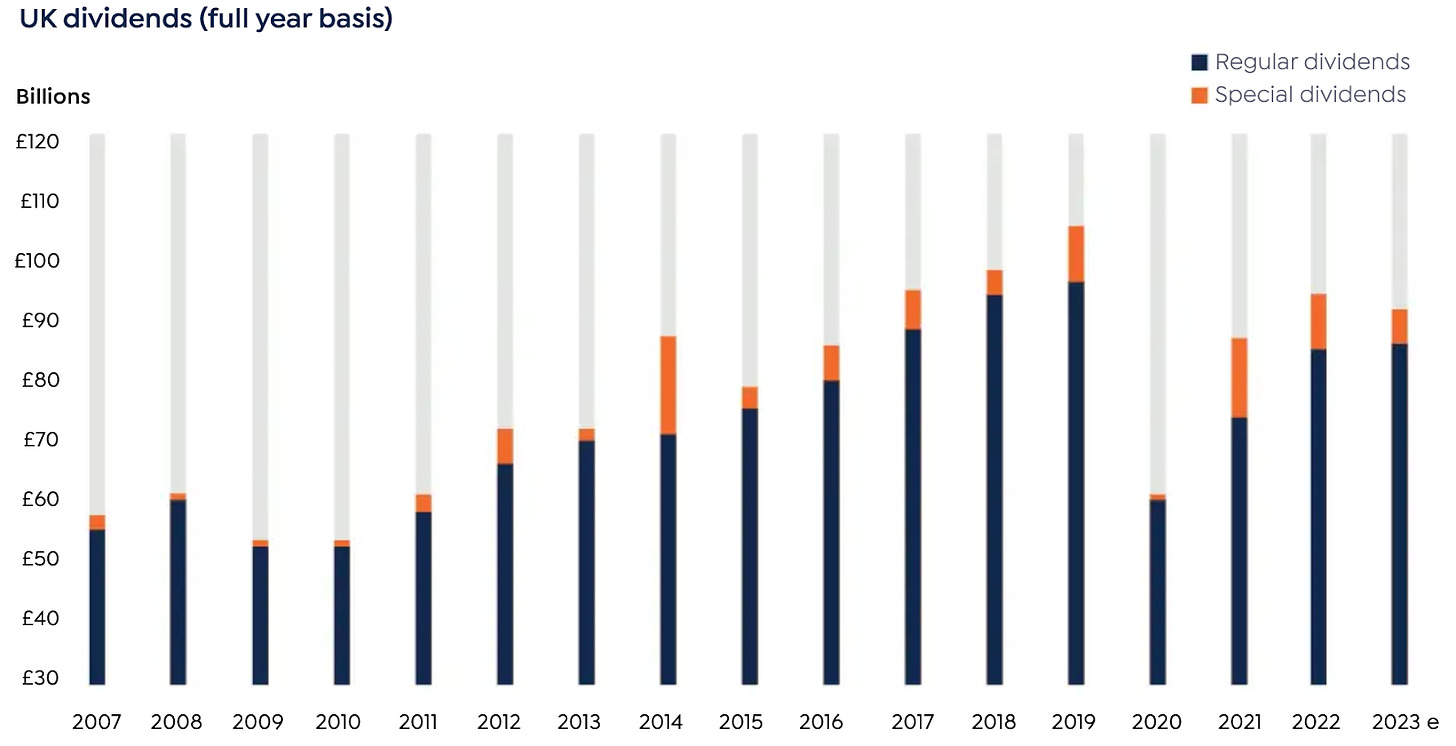

At the time, payouts from UK shares were being slashed by companies scrambling to shore up their finances. From a high of £106.7 billion in 2019, the total payout from UK-quoted firms collapsed to just £61.1 billion in 2020.

It was an unprecedented retreat.

Watching this in real time gave Smith an opportunity to repeat something he’d been saying for years: “no-one should invest in equities for income”.

Given that dividend income is the fund industry’s most popular investing sector, you could say this was quite an incendiary take.

While it’s true to say there was nuance in what Smith was saying, the fact was that he loathed the ‘equity income’ classification. He thought the rules to get into that sector were far too easy, making the whole premise of ‘equity income’ funds a “ridiculous piece of deception”.

But there was almost certainly another reason why he hated ‘equity income’.

Smith started his Fundsmith Equity Fund in 2010 and didn’t experience a single down year in a decade. His returns and his reputation were literally peerless.

But one niggle that did emerge in that time was the launch in 2014 of the Woodford Equity Income Fund by Smith’s high profile rival, Neil Woodford.

Slick PR and the tailwind of being an ‘equity income’ fund gave Woodford the upper hand as a popular pick in the fund selections on major investment platforms like Hargreaves Lansdown.

In public, Smith more or less held his tongue, but it must have seriously pissed him off. Not least because he was absolutely right about the ludicrous classification system.

Woodford famously went off piste and filled much of his fund with small, illiquid positions that weren’t making any money, let alone paying any dividends. When it all blew up in 2019 because redemptions couldn’t be covered, it confirmed everything that Smith had taken issue with.

But it’s not like Smith even had a problem with dividends. The nuance in his commentary was that dividends ought to be thought of as just one component in the total return you get from shares. The other being from the share price appreciation that comes from companies reinvesting profits to grow over time.

What he was really advocating to investors was to go in search of the highest total return possible, in whatever sustainable combination of earnings growth and dividend income you can find.

He warned that far too many FTSE companies had for too long been paying out too much in dividends, and not retaining profits for further growth. He thought Covid would be the moment when boards would reset their payout policies to something more sustainable.

So has that happened? There are signs that it has, but perhaps not for the reasons he thought.

This week, we got the dividend payout data for the fourth quarter of 2022, giving us a complete picture of how last year shaped up.

As you can see from this chart, the total payout is roughly back to where it was in 2017. Forecasts for next year currently put it slightly lower.

So a recovery of sorts in the early post-Covid years (helped to the tune of £3.8 billion by favourable exchange rates). But the £94.3 billion paid out in 2022 is still some way short of the highs of recent years.

And now, of course, there are other things to think about. High and rising inflation, interest rate hikes and a consumer spending squeeze have all put pressure on profit margins. Corporate borrowing will likely get more expensive from here, putting an end to a period of ‘free money’. Capital allocation, investment and project financing could well come under the microscope - and all of this could impact on dividend payouts.

So it seems Smith was right, but for reasons perhaps even he didn’t see.

Either way, this pressure on dividends is certainly cause for extra attention for investors. Which means finding that balance between earnings growth and income looks set to get tougher.

And while Smith was right to say what he did, other potentially nefarious trends are now emerging.

Last year share buybacks - when companies instigate a programme of hoovering up their own stock in the market - rose to a record £50 billion. In Link Group’s words, companies repurchased just over 2% of the overall market capitalisation last year - double what was seen in 2021.

Being kind, buybacks in a falling market could be seen as an astute move. Companies tend to be criticised for terrible market timing when it comes to repurchasing their own shares - so doing it in a bear market could make sense.

However, buybacks are fraught with catches and can easily end up destroying value. They have been a huge feature in US markets in recent years but attract strong criticism in some quarters - especially when it looks like executives do them to enrich themselves.

The latest UK dividend data suggests that payout growth was crimped by this rise in buybacks last year. If that turns into a trend, investors are going to have to tread carefully.

A vociferous buyback critic on this side of the pond has been… you guessed it… Terry Smith. So while he might have been right on dividends, other fights beckon.