Moats, duration, Michael Mauboussin and momentum - the best investing blogs and podcasts from the past week

This week it was Warren Buffet’s 92nd birthday and as tempting as it is to fill this newsletter with time-worn quotes from the undisputed legend of investing, I won’t. Instead, I’ll join a few dots between one of his most vivid descriptions of business quality - the ‘economic moat’ - and some of the present day market questions that I’ve been reading about lately.

Last week I wrote about whether rising inflation was a good thing for value stocks. Many seem to think it is, but some research suggests otherwise. A bigger picture here is about ‘duration’: short duration versus long duration and the impact that rising inflation (and the rising interest rates used to counter it) have on securities in each of those buckets.

You can think about short duration securities as the ones we know most about (there’s more certainty and less expectation with them). If it’s a bond, it’s short-term: one with yields that are unlikely to be eaten away by inflation. If it’s a stock, it’s a mature one that in theory has known and dependable cash flows.

Conversely, long duration bonds are long-term, with yields vulnerable to the gnawing effects of inflation. Likewise, long duration stocks are a bit more unproven. There’s expectation of future cash flows baked into their valuations, which makes them vulnerable if the outlook gets gloomy.

From here, you can see why growth and value are proxies for long and short duration. And so it makes sense that with markets in the state they are, you might opt for short duration stocks because of the certainty they give you. But is that the right conclusion?

Warren Buffett has declared many times his affection for companies with durable competitive advantages. He calls them ‘moats’, and the deeper and wider the moat, the more likely a business can compound above-average returns for unusually long periods. It’s a powerful metaphor.

But if you’re a buyer of stocks with moat-like characteristics should you be thinking in terms of short or long duration?

Well, a problem with moats is that the financial clues to finding them focus on the past: solid, long-term profitability as evidenced by high margins, return on capital, cash flows, etc. With moats, you rely on the past rhyming with the future, and that the financial resilience will persist. But given the ruthlessness of business cycles, time is always against these firms.

By contrast, you could argue that moats are born early in the business cycle, where companies are growing and reinvesting rapidly. And from an investment perspective it makes sense to be looking for early clues in smaller and perhaps less understood companies. That means taking a long duration approach.

The market is in no mood for this kind of thinking at the moment. But dare I say it, as Warren Buffett once opined…

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it's imperative that we rush outdoors carrying washtubs, not teaspoons.”

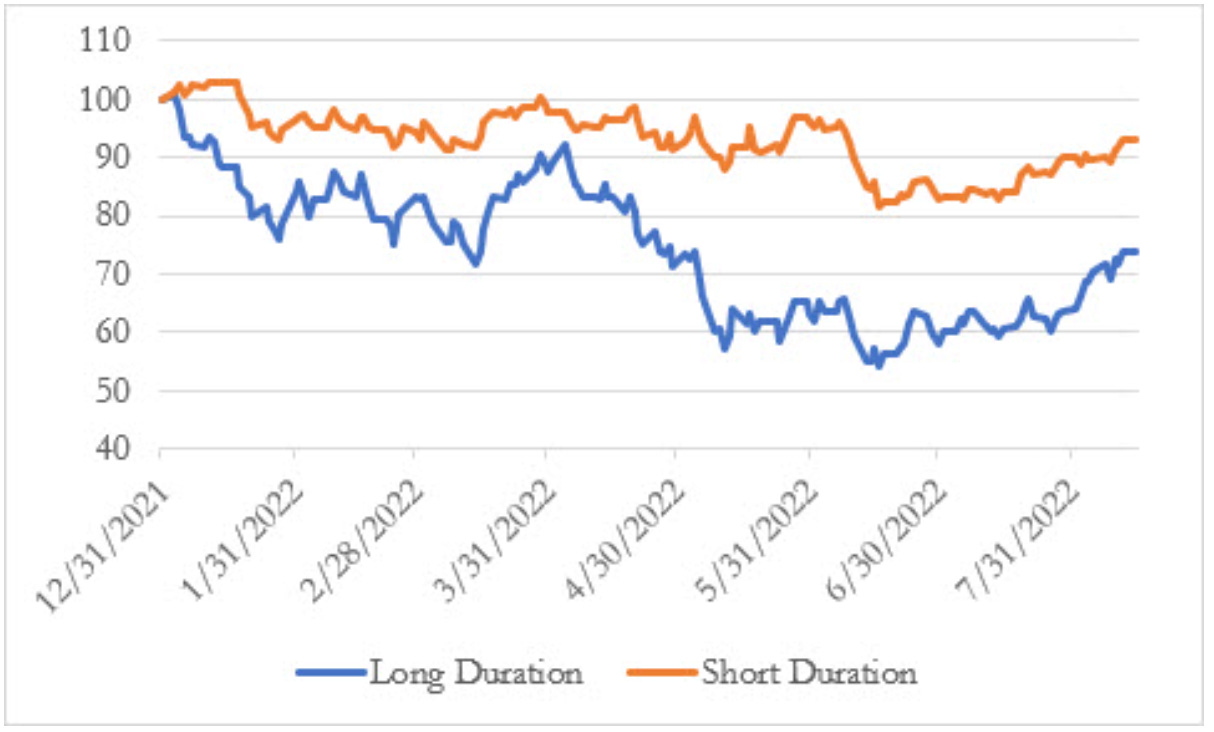

For a much fuller exploration of these themes, this article from Todd Wenning at Ensemble Capital is an excellent place to start - Equity Duration & Inflation: Defining Equity Duration. It’s the first of a three part series. I’ve stolen from him this chart of the performance of long and short duration stocks this year:

Source: Todd Wenning / Ensemble Capital

Top posts from the past week:

Frederik Gieschen for Compound - Reflections on the Investing Process with Michael Mauboussin

Frederick is the guy behind Neckar’s Minds of the Market, which I mentioned in last week’s newsletter. This week I’m following that up with an interview he did with Michael Mauboussin a few weeks ago for Compound. I’ve also mentioned Mauboussin before because he’s such a major influence in so many spheres of business, investing and psychology. This interview is a 38 minute read but is fascinating - starting with his introduction to Amazon during the dotcom boom, his views on forecasting, expectations and learning. Later on it takes a deeper dive into the details of the investing process. Mauboussin wrote the 2001 book Expectations Investing (recently updated) but some of it was very academic in its view of investing and markets and perhaps fell a bit flat because of that. Even so, in conversation he seems very engaging and his stuff is definitely worth a read.

Behavioural Investment - Most of Us Are Secret Momentum Investors

One of the curious things about “momentum” as a major driver of stock market returns is that, in a sense, it appeals to human instinct (and in part it’s believed to work precisely because of deep rooted human behaviour). So in that respect it’s at odds with other factors like value (unappealing), size (small-caps are scary) or low volatility (boring) where psychology stands in the way of success. But the fact is that real momentum investing is a lot trickier than one might initially think. In my former life I read a lot of academic research into momentum. And while its existence is beyond question, not everyone agrees on what causes it. This post from Joe Wiggins is a good reminder of what momentum really is and how it should be used.

Joachim Klement - Trust but falsify in action

Back with a bang from his summer break, Joachim picks up a theme from a few weeks ago about the need in finance and investing to continually question assumed knowledge. In the fields of physical sciences, where human health and wellbeing is at stake, scientific findings are always being tested, and occasionally dumped. But that doesn’t happen so much in economics, where old models seem to hang around no matter how much new research exists to discredit them. It’s a pet hate for Joachim, and he’s got a point.

Invest Like the Best with Patrick O'Shaughnessy - David Senra - Passion & Pain

David Senra has spent much of his life reading about and studying history’s great founders and entrepreneurs - and he’s the host of the Founders Podcast. This conversation with Patrick O’Shaughnessy begins with Senra finding strength and thriving despite his own difficult background - and how those kinds of experiences so often drive others. It then covers what he’s learnt from more than 300 biographies, taking in ideas like obsession (and Senra’s own obsession) and how it motivates people to work relentlessly. They also cover issues like, ego, breaking the law, constant learning and marketing. It’s hard to list all the founders and books mentioned, but they include Enzo Ferrari, Sam Walton, Estee Lauder, Steve Jobs, Thomas Mellon, Michael Jordan, Bob Dylan and Walt Disney. Overall, it’s a thought-provoking discussion about doing what you love, what drives people and the extremes they go to in order to make their businesses a success.

Monevator - SPIVA: the evidence against active funds

As much as he tends to eschew the DIY stock picking approach to investing, Monevator will always find a warm welcome here with articles like this. Let’s face it, who can resist a bit of schadenfreude when it comes to active fund manager performance, especially given how markets have behaved this year. S&P’s Spiva Scorecards keep a track on the performance of active funds relative to index benchmarks. It’s a slightly biased view of things but it is a reminder of how difficult consistent active outperformance really is. This excellent review focuses on the UK but for international readers I’ve dug out the link to the Spiva website so you can peruse the poor performance at your leisure - SPIVA Scorecard results for markets around the world

Have a great weekend - and don’t forget to check out the best of the rest investment blogs and podcasts below…

Ben

Thinking & Strategy (Blogs)

A harsh winter is coming - but what can we do about it?

Fund research from Trustnet

Useless Financial Ombudsman and FCA plus Defective Insolvency Regime

Roger W. Lawson's Blog

Prudent youngsters, reckless oldies

Klement on Investing

DIY Trend-Following Allocations: September 2022

Alpha Architect

Crowd Control for Fund ManagersMSCI

Savers of the World Rejoice — Yield is Back

A Wealth of Common Sense

The impact of uncertainty on investor behaviour

The Evidence-Based Investor

Three Big Things: The Most Important Forces Shaping the World

Morgan Housel

Focus to Win

Farnam Street

What’s wrong with Inverse ETFs?

FactorResearch

We Just Can’t Help It

Investor Amnesia

Thinking & Strategy (Podcasts)

Episode #440: Jason Buck, Mutiny Fund – Carry, Convexity & The Cockroach

Meb Faber Research – Stock Market and Investing Blog

Animal Spirits: Why So Bearish?

A Wealth of Common Sense

Everything Investors Need to Know About Federal Reserve Policy with Cullen Roche

Excess Returns

Vitaliy Katsenelson—Soul In The Game (EP.121)Infinite Loops

CrowdStrike: Cyber SaaS - [Business Breakdowns, EP. 72]

Business Breakdowns

Philipp Freise, Co-Head of European Private Equity at KKR, Highlights the Opportunities in Europe

The Money Maze Podcast

#96 Tom Hougaard: Best Loser Wins

The AlphaMind Podcast

Nick Maggiulli Joins Us to Talk About Just Keep Buying

The Investing for Beginners Podcast - Your Path to Financial Freedom

Securities & Markets (Blogs)

Small Caps Live Weekly Summary

Small Caps Life

Cisco Systems (CSCO) : Lessons from the Dot-Com Bubble

Dividend Growth Investor

Recent Stock Purchase II August 2022

DivHut

British blue chips are on the rise, but recession could torpedo prospects

The Guardian

Jeremy Grantham: Prepare For An Epic Superbubble Finale

The Acquirer's Multiple

Panic Journal – Ukraine/Russia edition part 4: Power & Gas prices, Merit Order and other Ramblings

value and opportunity

Securities & Markets (Podcasts)

Store of Value

The Reformed Broker

The Companies and Markets show: Braemar, Shell & BP, what is behind Sterling's weakness?

Investors' Chronicle

Can Amazon Save Peloton?

Stock Club

Funds Fan: why fund size matters, and Fundsmith challenger interview

interactive investor

E99 - Hays, Persimmon, Balfour Beatty, BHP, Supreme & Nvidia

The Investor Way

[Podcast] SOMERO ENTERPRISES With Mark Atkinson And Maynard Paton

Maynard Paton

Liontrust's Anthony Cross: Recessions tend to be more regional in their impact

Investors' Chronicle

Consolidating the Mechanical and Electrical Contracting Industries with Brian Lane, President and CEO of Comfort Systems USA, Inc. (NYSE: FIX)

Compounders: The Anatomy of a Multibagger

Small Caps Podcast with Paul Scott – Episode 9

Quality Small Caps

Weekly Investment Trust Podcast with Jonathan Davis (27 Aug 2022)

Money Makers